Several weeks ago, we explored Xledger’s options for data entry. This week, I’ll be giving you a quick tour of Xledger’s workflow.

As a web-based solution, Xledger eliminates paper-based approvals. From first entry to payment approval, you can run an entire approval process without physical papers ever changing hands. This doesn’t just drive cost and energy savings; it creates a complete audit trail.

Now, workflow is almost never as simple as I will present it here. Xledger allows clients to make their workflows as complex or as straightforward as needed. As an executive, you can define separate approvers for individual dimensions—assigning approvers by cost center, or project. You can assign one individual to approve transactions over $10,000, another to approve those over $1 million.

Bottom line: you have nearly unlimited flexibility to set up workflow in Xledger. For the purposes of this blog, however, I want to keep it simple. Because while the process can be complex, the principles aren’t.

So I’ll walk you through a simplified workflow, but one that still represents the basic ideas.

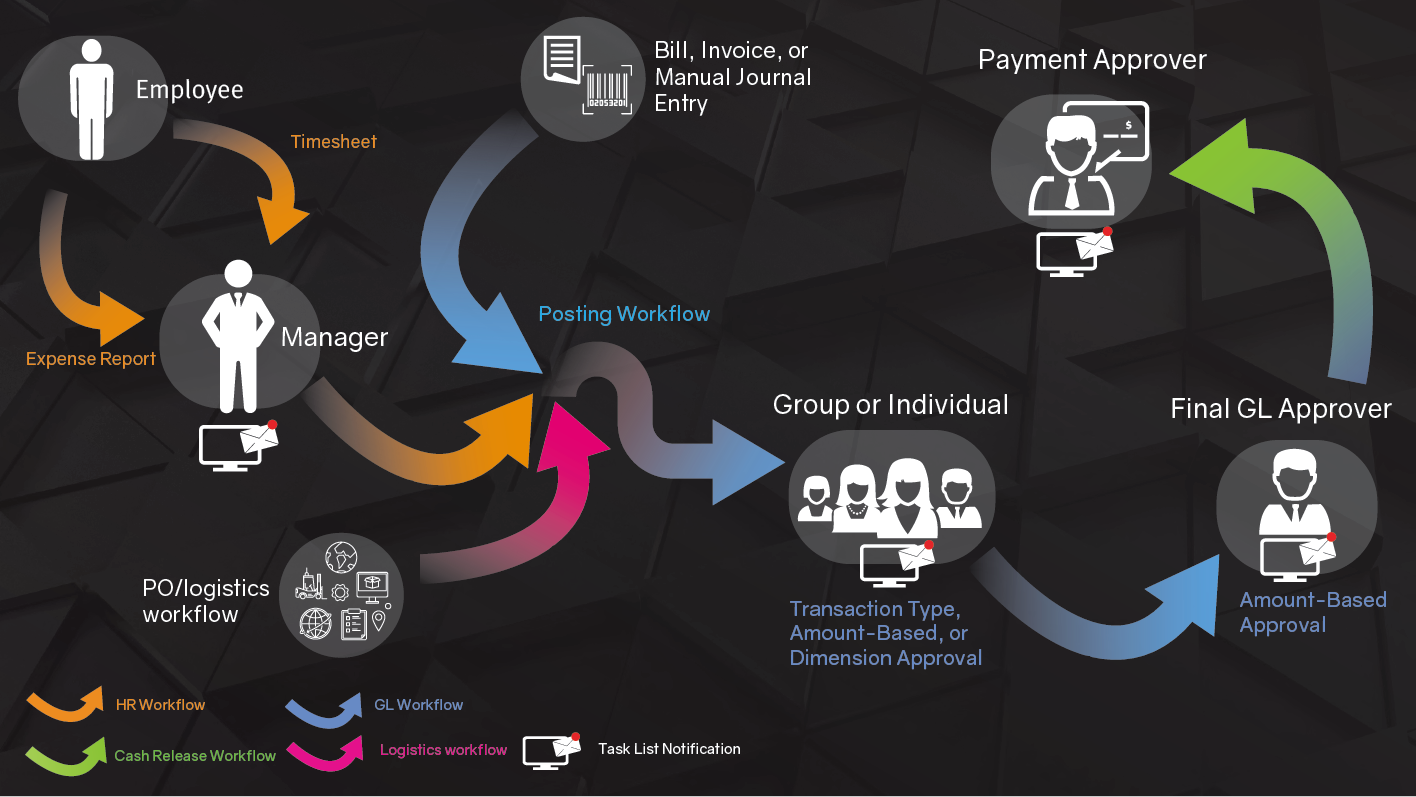

To begin with, Xledger routes documents and transactions through one of three initial workflows before they reach the path to final approval. In this example, the accounting department acts as the gatekeeper to this final sequence.

The initial workflows are as follows:

- Expense reports and Timesheets. A sales rep enters an expense report for lunch at a recent industry conference. Their direct manager reviews and approves it. It moves to accounting.

- PO/Logistics. A clerk creates a purchase order for new barcode scanners. The procurement manager reviews and approves it. It moves to accounting.

- Bill, Invoice or Manual Journal Entry. Using one of Xledger’s data entry methods, a receptionist enters an invoice they received for a recent delivery of office chairs. Xledger reads and slates it for posting approval. It moves to accounting.

Once a document or transaction reaches accounting, it still faces at least three additional approval stages. (Here, again, we are speaking in very general terms).

First, a staff accountant reviews and approves the document or transaction by type, amount, or dimension. Dimensions could include anything from region and entity to cost center and amount. Some clients have five individuals as approvers here, while others have fifteen.

Second, a chief accountant reviews and approves the amount.

In the third and final stage, accounting typically cedes to upper leadership. A decision maker—whether a project manager or a CFO—will perform a final review, often focused on amount. Once they approve it, the document or transaction is slated for payment.

Xledger tracks every part of these workflows. The resulting audit trail does more than make auditors faster and more accurate. Action tracking also equips leaders to identify internal threats and prevent catastrophic insider breaches.

For a visual depiction of Xledger’s workflow, see the infographic below.

Please reach out with any questions. I’d love to go into greater depth with you.